arizona estate tax exemption 2020

It consists of an accounting of everything you own or have certain interests in at the date of death Refer to. Attorneys personal representatives or fiduciary of a trust or estate can request a Certificate of Taxes from Arizona Department of Revenue based on any of the.

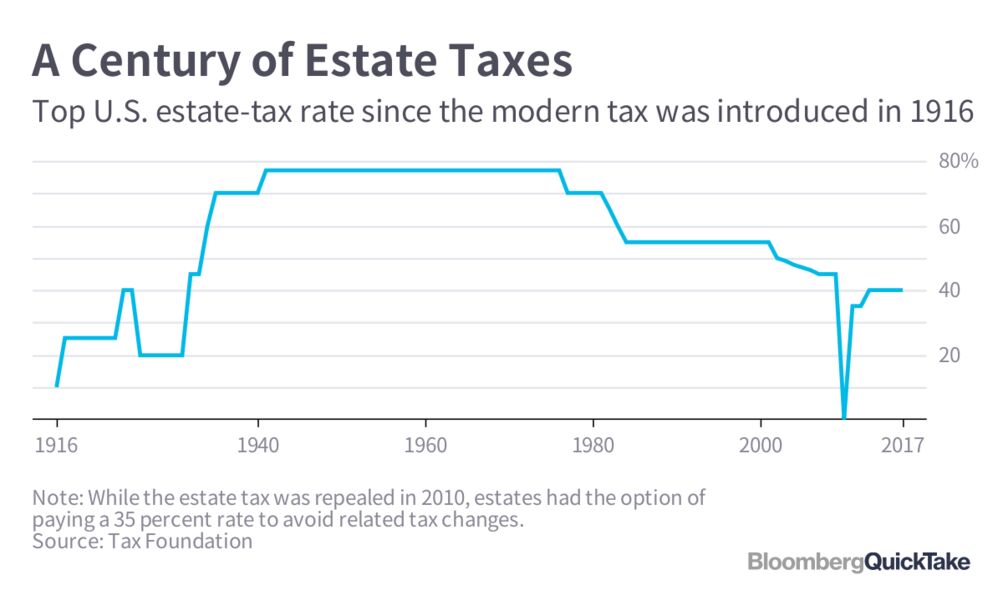

Is The Estate Tax Unfair Double Taxation Or An Inequality Fix Bloomberg

Federal estate tax planning.

. The amount of the federal estate tax exemption is adjusted annually for inflation. Except as provided in subsection C of this section on the tax payment dates prescribed in section 20-224 each health care services organization shall pay. 255 on up to 54544 of taxable income for married filers and up to 27272 for single filers High.

Arizona Department of Revenue. For the most part an individual may. In 2020 there is an estate tax exemption of 1158 million meaning you dont pay estate tax unless your estate is worth more than 1158 million.

Federal law eliminated the state death tax credit effective. This establishes a basis for. Fiduciary and Estate Tax.

Federal estate tax return due nine months after the individuals death though an automatic six-month extension is available if asked for prior to the conclusion of the nine. The purpose of the Certificate is to. The Estate Tax Exemption Amount Goes Up for 2021 Serving Queen Creek Gilbert Mesa San.

This Certificate is prescribed by the Department of Revenue pursuant to ARS. The department created exemption certificates to document non-taxable transactions. Once you calculate your gross estate and then deduct any.

With the stroke of his pen on December 22 2017 President Donald Trump increased this exemption to 11200000 per individual and 22400000 for married couples. Does Arizona collect an. 1600 West Monroe Street.

For certain business situations transactions are not subject to TPT. An individual may claim itemized deductions on an Arizona return even if taking a standard deduction on a federal return. 298 on over 54544 of taxable.

TPT Exemption Certificate - General. Even though Arizona does not assess an estate or gift tax The federal government certainly does. The Estate Tax is a tax on your right to transfer property at your death.

The Arizona estate tax return was based on the state death tax credit allowed on the federal estate tax return. Every corporation doing business pursuant to this article is declared to be a nonprofit and benevolent institution and to be exempt from state county. Every authorized society and every society that is exempt under section 20-893 is deemed to be a charitable and benevolent institution and is exempt.

By 2017 the federal estate tax exemption had risen to 549 million per individual due to the inflation feature and a nearly automatic 1098 million for married couples who follow very. Arizona Income Tax Range.

Tax Implications Selling A Home Ownership Test Tucson Phoenix Az

10 Most Tax Friendly States For Retirees Kiplinger

Arizona Estate Probate 520 Home Buyers

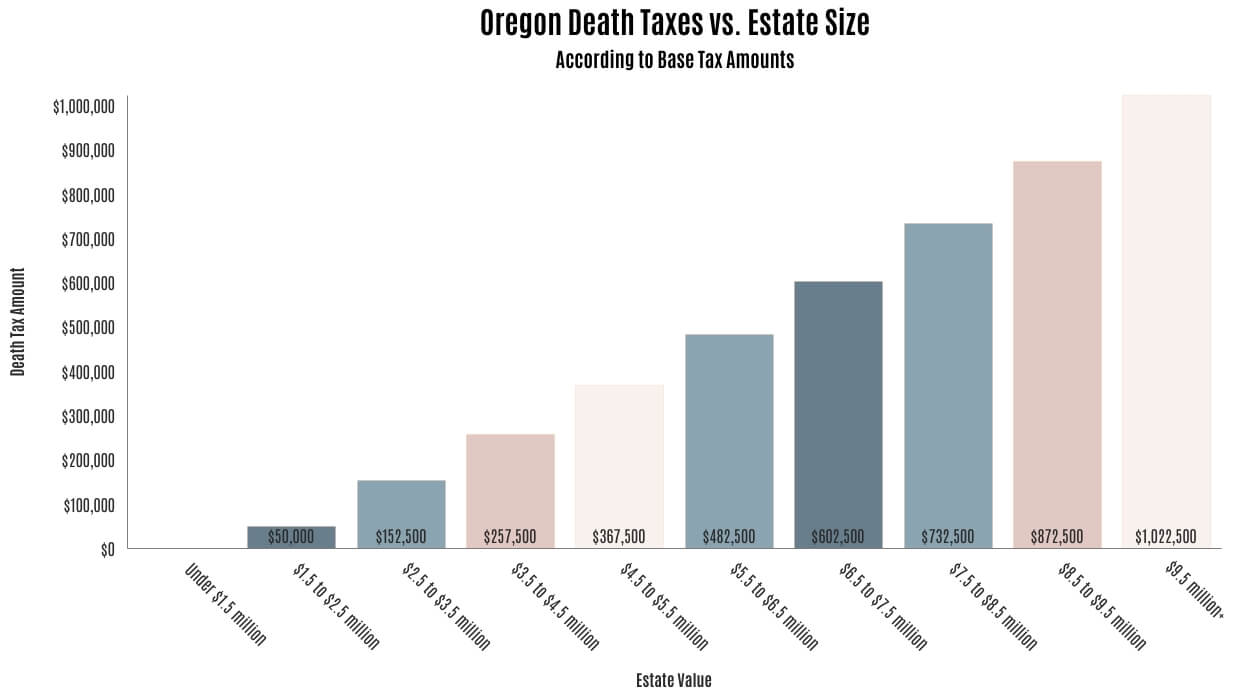

Oregon Death Taxes Death Taxes In Central Oregon De Alicante Law Group

State Estate And Inheritance Tax Treatment Of 529 Plans

Where Not To Die In 2022 The Greediest Death Tax States

Capital Letter No 51 The American College Of Trust And Estate Counsel

Arizona Estate Tax Everything You Need To Know Smartasset

Estate Tax Planning In Arizona Gilbert Az Estate Planning Law Firm

Estate Planning Articles Loose Law Group Az

Property Tax In Colorado Post Gallagher What Can Be Understood From Other States Common Sense Institute

New Arizona Homestead Laws Will Delay Many Real Estate Transactions Macqueen Gottlieb Plc

Avoiding Basis Step Down At Death By Gifting Capital Losses

Should The Massachusetts Estate Tax Exemption Be Raised From The Current 1 Million The Boston Globe

Arizona Estate Planning Terms Definitions By My Az Lawyers

2020 State Tax Trends To Watch For Tax Foundation

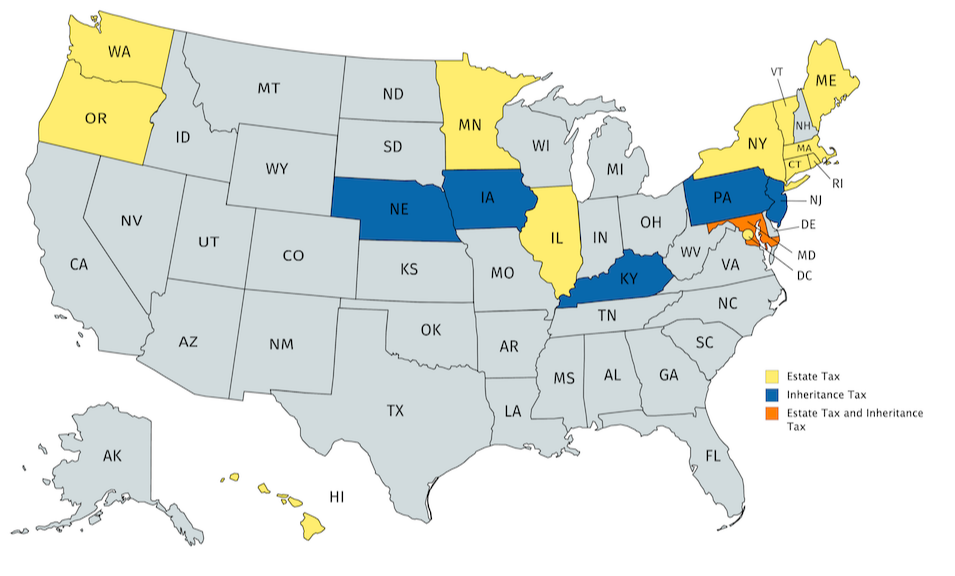

33 States With No Estate Taxes Or Inheritance Taxes Kiplinger

State Taxes On Capital Gains Center On Budget And Policy Priorities

Is The Estate Tax Unfair Double Taxation Or An Inequality Fix Bloomberg